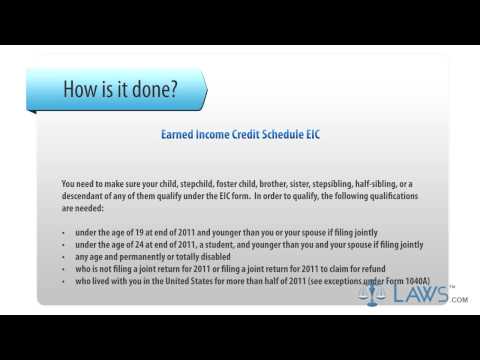

Laws dot-com legal forms guide Earned Income Credit schedule EIC step 1: You need to make sure your child, stepchild, foster child, brother-sister, step sibling, half sibling, or a descendant of any of them qualify under the EIC form in order to qualify. The following qualifications are needed: under the age of 19 at the end of 2011 and younger than you or your spouse if filing jointly, under the age of 24 at the end of 2011 and a student younger than you and your spouse if filing jointly, any age and permanently or totally disabled, not filing a joint return for 2011 or filing a joint return for 2011 to claim for a refund, and lived with you in the United States for more than half of 2011 (see exceptions under Form 1040a). - Step 2: In part 1, you only have to list three children even if you have more to get the maximum credit. Provide their full legal names. - Step 3: In part two, make sure the social security number agrees with the child's social security card. If the child was born in 2011 and died in the same year without a social security number, write "died" on the line and attach a copy of the birth certificate, death certificate, or hospital records. - Step 4: In part 3, enter the full year of the child's year of birth. - Step 5: In parts 4a and 4b, make sure you check all "yes" or "no" as they apply. The section is not complete if you leave any sections unchecked. - Step 6: In part 5, make sure the relationship qualifies as mentioned at the beginning of these instructions. - Step 7: In part 6, do not forget to watch more videos. Please make sure to visit laws com.

Award-winning PDF software

How to fill Publication 596 Form: What You Should Know

Form 8903 — Earned Income Credit (EIC) [2021] Fill out a separate worksheet for each Form 8814. Tax Form 8903, Earned Income Credit (EIC) [2021] Fill out a separate worksheet for each Form 8814. If you file Form 8844 or Form 8951, you must fill out a worksheet for each Form 8814. If you use Form 8844 or Form 8951, there are four worksheets to fill out. Fill out a worksheet for each of the Forms 8814 you use. You are not required to use the IRS Worksheet to figure your credit. If your state has a state minimum wage law which does not include the Alaska bonus then you must use Worksheet 1 on the form. If you did not provide the information listed in #4 above, do not use this worksheet, instead see: “Earned Income Credit (EIC) on Form 8903” or if your state has a state minimum wage law which does not include the Alaska bonus then use Worksheet 1 on the form. If you use the Alaska bonus, fill out all four worksheets on Forms 8903. If you do not pay the state minimum wage at all (such as your state has a flat minimum wage), use Worksheet 2 at the bottom of the form. Calculating Your Credit by State If you are using the “Alaska bonus” and state law does not have a state minimum wage, you should multiply that amount by 1.2 and round to the nearest multiple of. If you work in Alaska and the state minimum wage is 1, you should multiply that amount by the appropriate factor (2 for a 2.00 state minimum wage or 2.75 for a 3.00 state minimum wage). If your state minimum wage is less than 1 and the Alaska bonus and is equal or greater than the state minimum wage the bonus must be added to the amount from #1. The Alaska bonus cannot count towards your state minimum wage, and cannot be used in determining your actual minimum wage, if the state minimum wage rate is higher than your credit. Use Worksheet 2 if: your credit is not greater than 0.10 and your minimum wage is equal to or greater than the 2.20 per hour state minimum wage.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Publication 596, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Publication 596 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Publication 596 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Publication 596 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill Form Publication 596